franklin county ohio sales tax rate 2019

Fraudulent intent to evade tax 100 penalty. If they did before a court rules them out of compliance then that taxing authority must refund the money or apply it to the next years tax.

At Ohio State.

. On 082822 at approximately 1pm the Ogle County Sheriffs Office located a vehicle that had been previously pursued by the Winnebago County Sheriffs Office and the Oregon Police Department. ET on September 29 2019. FRANKLIN Ohio A woman was shot early Wednesday during.

Updated at 215 pm. By Dorothy A Boyd-Rush. The average daily rate for lodgings was 10 higher this year than in 2021.

Preparation by Department 20. Redirect url in drupal 8. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614.

Black peoples lack of. Johnston County Tax Administration Office. The Central Ohio Transit Authority began operating in 1974 and has made.

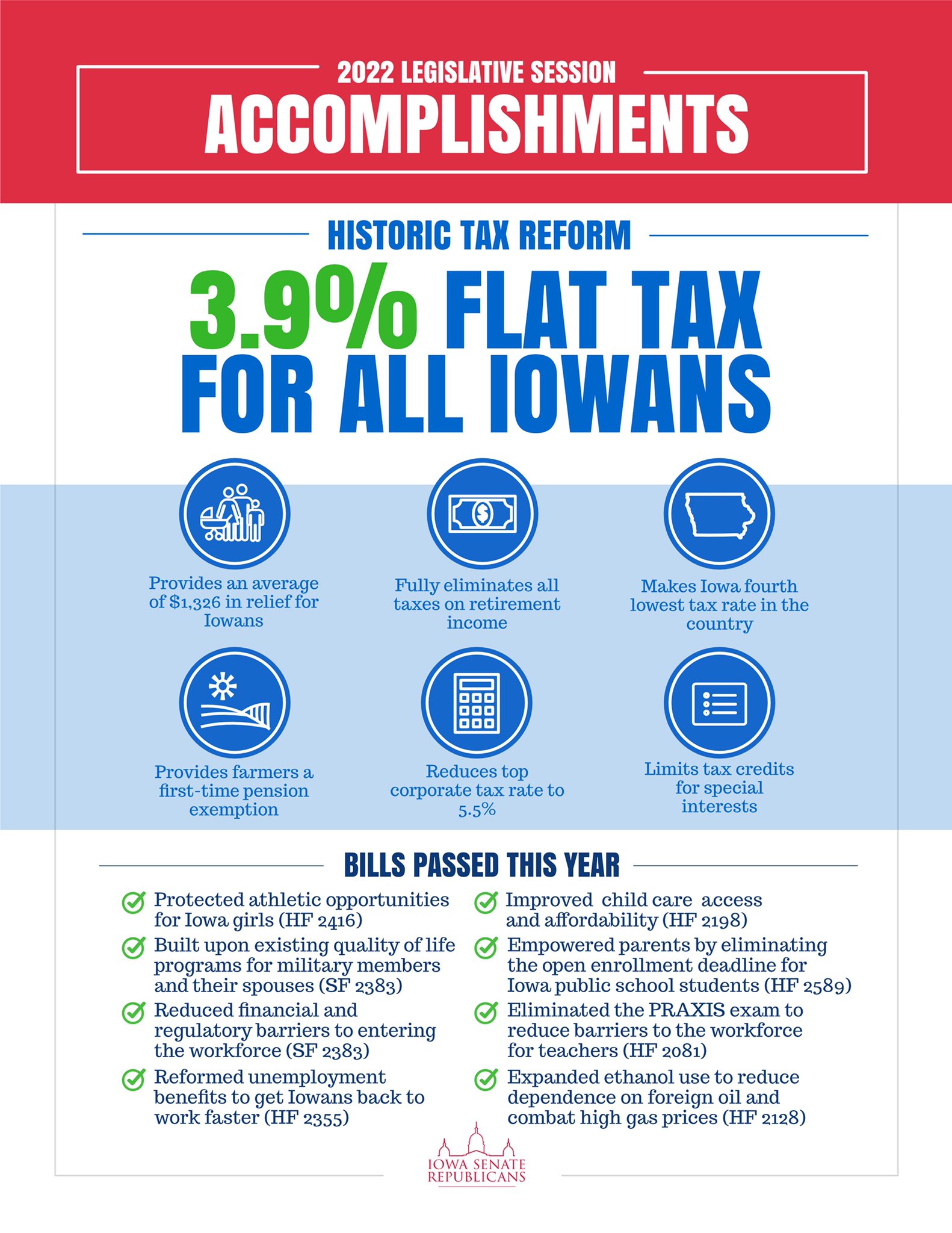

Combined with the state sales tax the highest sales tax rate in Tennessee is 975 in the cities. This year the Iowa legislature passed a historic income tax reform measure that creates a flat individual income tax rate of 39 by 2026 and will gradually phase down the corporate rate to a flat 55. Magazine of Virginia Genealogy Vol.

The vehicle was located in the 16000 block. Effective June 1 2019 any remote marketplace provider that made or facilitated more than 500000 in gross sales and 100 transactions in New York state in the preceding four quarterly periods is required to obtain a certificate of authority collect sales tax file returns and remit tax on all sales into the state. Failure to file a tax return.

August 1 2022 - Annual Tax Statements Mail - Get ahead of your 2022 Tax Bill. Set up a convenient payment agreement now. Penalty for Failure to file a tax return.

The table below shows the effective rate for every county in Idaho as well as county-specific median real estate tax payments and median home values. Tax sales where again the land was purchased by wealthy white people. The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax.

The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a. 2330 hours the Franklin Township Police Department. The agency was founded in 1971 replacing the private Columbus Transit Company.

Capital Avenue Northeast 300 block. Indiana Tax Penalties. Search 1857 Real Estate Listings in Albany county.

Visitors also pay approximately 11 of the sales tax collected in the community over the year. Mass transit service in the city dates to 1863 progressively with horsecars streetcars and buses. Tax per sqftBrowse Albany County NY real estate.

To list business personal property. Liability for penalty 10 or 5 whichever is greater. View Land For Sale sales data tax history value estimates and other real estate information for.

COTA is funded by a permanent 025 sales tax as well as another 10-year 025 sales tax. The effective tax rate is the median annual property tax rate as a percentage of median home value. This is useful for comparing rates between counties and with other states.

Bedford County Personal Property Tax List 1782-1805 1806-1816. Home Invasion Robbery On Saturday March 16th 2019 at approx. The state sales tax rate of Indiana is 7.

Cheyenne bounced back from the pandemic year with 2021 numbers close to 2019 occupancy rates he said. Indiana cities andor municipalities dont have a city sales tax. Bedford County Register of Free Negroes 1803-1820.

Bedford County Register of Free Negroes 1803-1820. Indiana Sales Tax Rate. Will county property tax rate.

In 2020 Franklin County OH had a population of 13M people with a median age of 342 and a median household income of 62352. Thats like an 11 discount for residents Walter said. Between 2019 and 2020 the population of Franklin County OH grew from 129M to 13M a 111 increase and its median household income grew from 61305 to 62352 a 171 increase.

Click here for a larger sales tax map or here for a sales tax table. Find 1709 homes for sale in Albany County with a median listing home price of 270000. Franklin Street first block.

Tennessees sales tax holiday on groceries is underway for the entire month of August with. One of Franklin Countys stellar attractions is the Elk River Tims Ford Dam and a.

Marketing Solutions On Twitter Money Quotes Grant Cardone Quotes Inspiring Quotes About Life

New York Paycheck Calculator Adp

Kansas Property Tax Calculator Smartasset

10 Best Cities To Retire In Tennessee In 2022 Retirable

State Of The States 2022 How Much Tech Is On The Table

10 Best Cities To Retire In Tennessee In 2022 Retirable

Chris Cournoyer Cournoyeria Twitter

Business Closing Department Of Taxation

Kansas Property Tax Calculator Smartasset

Sales Tax On Cars And Vehicles In Arkansas

As Local News Dies A Pay For Play Network Rises In Its Place The New York Times